Presidential aspirant Sen. Elizabeth Warren (D-MA) has revealed how she plans to pay for her Medicare for All plan – including a financial transaction tax that could delay the retirement of millions of American workers.

The tax on the financial sector would, according to Warren, raise “about $800 billion”[i]over the next 10 years by what is called a “small tax on financial transactions.” The financial transaction tax would impose a 10-basis point tax on the sale of bonds, stocks or derivatives, but there does not appear to be any exemption for investments in 401(k)s, IRAs or pension plans. Warren contends that the tax would be assessed on and collected from financial firms and would likely have “little to no effect on most investors,” and further suggests that it could help “ease what Americans pay in fees for their investments and reduce the size of relatively unproductive parts of the financial sector.”

However, the American Retirement Association warns that it’s going to come right out of the retirement savings of the middle class. “Contrary to what is being reported, the Warren proposal does, in fact, include a middle-class tax – a middle-class tax on retirement savings,” says Brian Graff, CEO of the American Retirement Association. The ARA points out that:

- an analysis by Vanguard shows that American workers will have to work 2½ years longer to make up for the lost retirement savings due to this new tax;

- a separate report by Modern Markets Initiative found that an FTT would siphon off $64,200 over a 40-year lifetime savings in 401(k)s and IRAs – or the equivalent of delaying the average individual’s retirement by 2 years; and

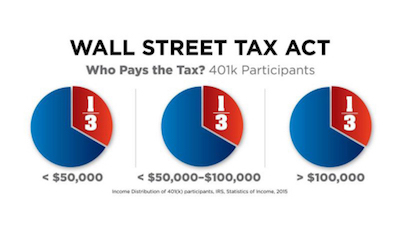

- a third of the more than 80 million participants in these plans make less than $50,000.

Warren is not the first to lean on a sweeping tax on investment transactions with no apparent exception for retirement accounts. Earlier this year, Sen. Kamala Harris (D-CA) introduced a similar proposal to pay for her “Medicare for All” proposal. In addition, Sen. Bernie Sanders (I-VT) co-sponsored the Inclusive Prosperity Act of 2019, which seeks to generate up to $2.4 trillion in “public revenue from wealthy investors” to help pay for a program that would underwrite forgiveness of student loan debt.

“Every week millions of Americans sacrifice to set aside part of their hard-earned pay for retirement, investing those savings to help provide a secure financial future,” Graff notes. “After years of attacking 401(k) plan fees, some now want to charge a fee every time a hard-working American contributes out of their pay into their 401(k). Saving for retirement is hard work. And those in Washington shouldn’t work to make it any harder.”

“Every week millions of Americans sacrifice to set aside part of their hard-earned pay for retirement, investing those savings to help provide a secure financial future,” Graff notes. “After years of attacking 401(k) plan fees, some now want to charge a fee every time a hard-working American contributes out of their pay into their 401(k). Saving for retirement is hard work. And those in Washington shouldn’t work to make it any harder.”

Similar analyses by the Securities Industry and Financial Markets Association (SIFMA) and the U.S. Chamber of Commerce further assert that an FTT will harm individual investors and have a drastic effect on retirement savings and many other aspects of the U.S. economy, including the capital markets such as the securities that support the housing market, operations of businesses and infrastructure financing.

[i]The financing portion of the $20 trillion plan (Warren’s estimates, though others claims that is a conservative figure) also includes proposals ranging from cracking down on alleged tax evasion, to changing the tax treatment of capital gains to imposing a country-by-country minimum tax on foreign earnings.

- Log in to post comments