April, it has been said, is the cruelest month. No offense to Chaucer, but CalSavers — the Golden State’s state-run retirement plan for private-sector employees whose employer do not offer one — may beg to differ. In the fourth month of 2023 its total assets surpassed half a billion dollars.

More precisely, CalSavers reports that as of April 30, 2023, its total assets amounted to $501,206,338. That was more than $27 million more than at the end of March; assets grew by almost 6% from March to April. Assets had started 2023 at $372,979,988 — spelling growth in assets of $128,226,350 from Jan. 1 to April 30, a 34% jump.

Other Measures

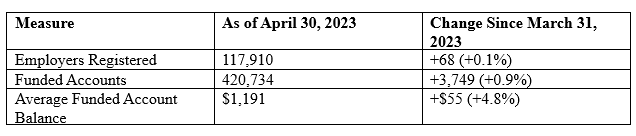

Growth. By other measures CalSavers showed growth in April as well, although it was more gentle.

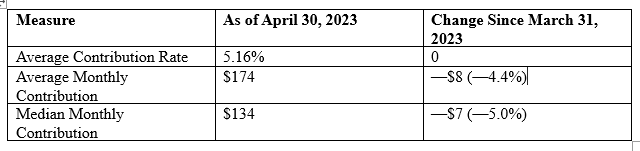

Spinning Tires. By some measures, CalSavers did not show growth in April.

Withdrawals

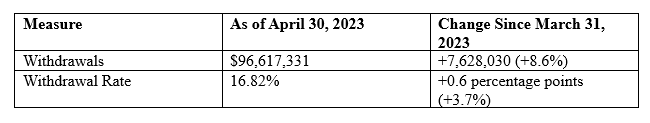

Employees have the option of withdrawing funds from their CalsSavers accounts. Those also grew from March to April.

It is worth noting that while there were more full withdrawals than partial withdrawals, the latter grew more than the former in April.

Opt-outs

Employees also have the option of withdrawing from the program completely. The rate at which they did so slowed from March to April. The opt-out rate fell from 36.5% in March to 36.34% in April, a drop of 0.16 percentage points, or 4%.

- Log in to post comments