Automatic enrollment provisions contained in SECURE 2.0 were the focus of an Oct. 23 presentation at the ASPPA Annual conference in National Harbor, MD.

Automatic enrollment provisions contained in SECURE 2.0 were the focus of an Oct. 23 presentation at the ASPPA Annual conference in National Harbor, MD.

Craig Hoffman, an Attorney/Senior Consultant with Nova 401(k) Associates in Houston, Texas, said that in SECURE 2.0, Congress went much further than it did in the Pension Protection Act of 2006.

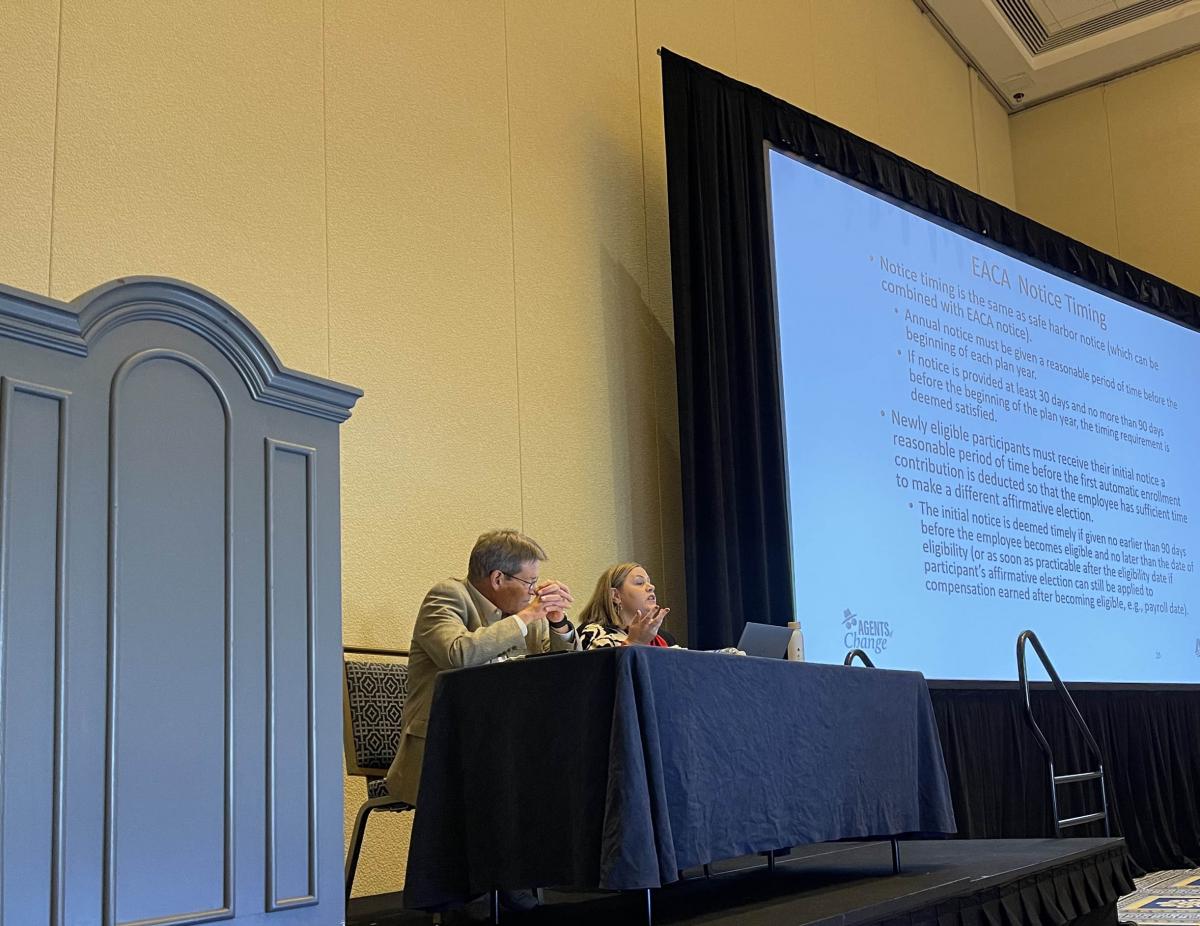

“Beginning with the 2025 plan year, most 401(k) and 403(b) plans established after Dec. 28, 2022, will be required to include automatic enrollment as a mandatory plan feature,” Hoffman explained. “SECURE 2.0 includes several requirements regarding the design of the automatic enrollment feature (including compliance with the Eligible Automatic Enrollment Contribution Arrangement—EACA) —requirements).

He added that although 2025 may still be some time off, plan sponsors need to confirm with plan recordkeepers, payroll providers, and administrators that all will be ready to comply.

He noted that SECURE 2.0 also mandates the following default contribution and auto-escalation rates:

- During the first year of participation, not less than 3% and not more than 10%.

- The default rate must then increase by 1% each year thereafter until reaching at least 10%.

- The annual increase must be effective on the first day of each plan year “after each completed year of

- participation.”

- The endpoint for auto-escalation must be between 10% and 15%.

- Auto escalation may be avoided by setting the initial default contribution percentage at 10%.

Finally, he explained the plans subject to SECURE 2.0 mandates and those that are not.

“The new mandate only applies to 401(k) and 403(b) plans established after Dec. 28, 2022,” he said. “It’s not clear what it means for a plan to be ‘established’ by Dece. 28, 2022, and therefore grandfathered. Is it sufficient that a plan document was signed before the deadline if the plan was not effective until Jan. 1, 2023? What if a grandfathered plan is merged with a plan established after the deadline (or vice versa)?”

What about plan spinoffs, Hoffman asked?

“SECURE 2.0 specifically provides that employers without a plan who join a MEP are considered to establish their plan on the date they join the MEP, not the MEP’s establishment date. IRS guidance will be needed,” he explained.

In addition to grandfathered plans, SECURE 2.0 exempts other plans from the mandate, such as SIMPLE 401(k) Plans, church and governmental plans, plans sponsored by entities that have been in business for less than three years, and plans sponsored by employers who “normally employ” no more than 10 employees.

The mandate applies one year after the close of the first tax year in which the 10-employee threshold is exceeded, he said before adding that IRS guidance needed to clarify what it means to “normally employ” an employee.

- Log in to post comments