A formal, written plan (FWP) for managing income, expenses, and assets in retirement is fundamentally a tool that heightens financial security and clarifies what needs to be done in running an account. But it’s more than that, as an industry experts outline.

The proportion of Americans completing retirement planning activities “has held steady for years,” Matthew Drinkwater, Corporate Vice President for Annuity and Retirement Income Research at LIMRA and LOMA told ASPPA Connect. Still, recent studies show having a formal retirement plan can be an asset in a variety of ways but that its value is underappreciated.

Confidence Booster

Drinkwater reports that LIMRA’s research has found that creating an FWP “is associated with positive outcomes for both investors and FPs.” He points to a survey of investors conducted in 2020 in which 59% of clients with a FWP “strongly agreed” that they would like to work with their financial professionals (FPs) for the rest of their lives, while 37% of clients without plans said so. He continues, “A similar percentage (61%) of financial professionals surveyed in 2021 believe FWPs ‘boost clients’ loyalty and confidence’; 44% of FPs say that such plans ‘make it easier to discuss product solutions’ and 27% say they are necessary for product sales to happen.”

LIMRA in its research found that 87% of those with an FWP felt confident about being able to afford the lifestyle they want, 17 percentage points higher than the percentage of those lacking one who felt confident about that. Similarly, Goldman Sachs Asset Management found in a recent study that 78% of retirees with a retirement financial plan were confident in moving from employment to retirement, and 79% of those in their study who had a plan were on track or even ahead of schedule with saving for retirement.

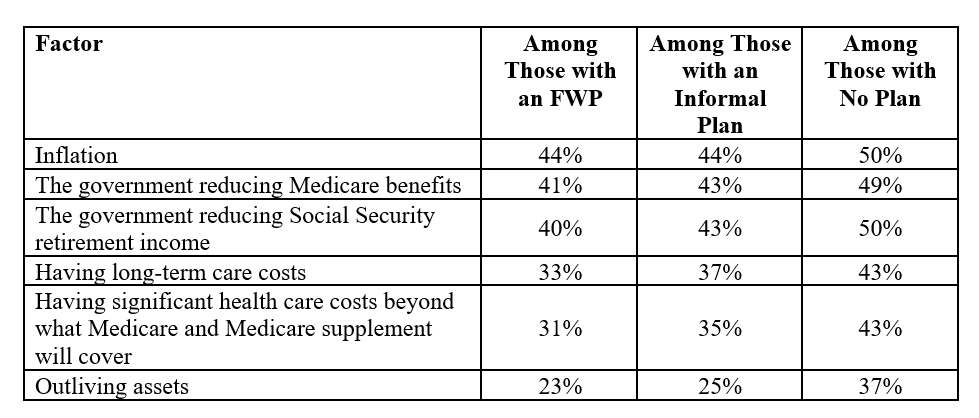

Drinkwater says that in its Analysis of 2023 Retirement Investors Survey, LIMRA found that having an FWP can reduce concerns about certain risks that could befall or affect a retiree. “We found that FWPs are associated with risk perception, such that those with FWPs were generally less concerned than those without any plan,” he says.

Drinkwater elaborates, “We have witnessed an increase in the proportion of Americans expressing concern about outliving assets over the past 15 years,” adding that “concerns about longevity tend to be less common than concerns about public policy risks (i.e., reductions in Social Security or Medicare benefits, or tax increases) as well as inflation.”

Percentage of Investors Concerned About Various Risks

Source: LIMRA Analysis of 2023 Retirement Investors Survey.

Readiness

Actual readiness to retire is even more important than confidence in it, and Theresa Conti, QKA, APR, ERPA, President of Sunwest Pensions, tells ASPPA Connect that she has noticed a difference between the retirement readiness of those who have an FWP and those who do not.

Work to Do

FWPs may heighten confidence and help in saving, but they appear to be a well-kept secret: only around 20% of investors have one, Drinkwater reports.

“Since 2014, the proportion of investors (age 40 to 75, with $100,000 or more in household investable assets) who have created a FWP has increased slightly, from 18% to 21%,” Drinkwater says, adding that “there was a bump up in the proportions during 2021 and 2022, possibly indicating that the COVID-19 pandemic spurred investors and their FPs to re-assess their financial/investment situations and re-visit or re-create FWPs.”

Conti also thinks that participants don’t appreciate the importance of an FWP, but that they should. “I think if they took the time to do one, they would participate at a higher level to assure they are ready when retirement comes,” she says.

Not only that, says Conti, while FWPs can heighten retirement readiness, not all employees consider pursuing one. She told ASPPA Connect she thinks “only highly compensated employees typically take the time to do them.” She adds, “I think many lower paid employees think they don’t have ‘enough money’ to talk to someone and therefore get left out and don’t know how much to save.”

Action Steps

Online options are a way to make establishment of FWPs more accessible for “regular” participants, Conti suggests.

Drinkwater strikes a similar tone. He notes that FPs usually create FWPs for clients, and that employer and plan sponsor involvement with the development of FWPs usually centers around offering personalized advice and making online tools and calculators available to plan participants.

- Log in to post comments