After enduring one of the worst stock markets in decades, health savings account (HSA) investment assets have grown rapidly, according to Devenir’s 2023 mid-year HSA market survey report.

As part of its 26th semi-annual HSA survey, Devenir reports that, at the mid-point of 2023, $116 billion in HSA assets was held in almost 36 million accounts—a year-over-year increase of 17% for assets and 6% for accounts.

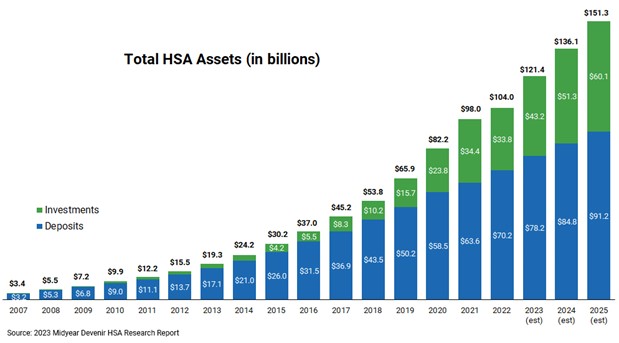

What’s more, during the first half of 2023, HSA investment assets grew 20%, totaling $40 billion at the end of June (up 30% from the year prior). This was after declining from $34.4 billion in 2021 to $33.8 billion in 2022. In addition, 35% of all HSA assets are in investments as of June 30, 2023, compared to 32% in 2022.

Notably, for HSA investment accounts, the report shows an average total balance of $18,362 (deposits and investments combined), which is 7.3 times larger than an average funded non-investment holder’s account balance.

“As Health Savings Accounts near their 20th year, they have become a vital financial tool for nearly 36 million people, holding $116 billion in assets designated for healthcare expenses now and in the future,” stated Jon Robb, senior vice president of research and technology at Devenir.

Yet, while the number of HSAs investing continues to grow, the rapid growth seen over the past few years has slowed, the report further notes.

Additional findings show that almost 2.7 million HSAs—representing over 7% of all accounts—have at least a portion of their HSA dollars invested.

“We continue to see seasonality in the percentage of accounts that are unfunded,” the report explains, adding that accounts are often opened during the fall open enrollment season, but remain unfunded until early the following year. Halfway through 2023, about 18% of all accounts were unfunded, down from 19% a year ago.

In addition, HSAs opened during the first half of 2023 had an average balance of $1,143 at the midyear point, compared to a $1,464 average balance at the midyear point of 2022.

Interestingly, Devenir believes that a contributing factor to the higher balance of new accounts in recent years was the reporting of M&A or account transfers from existing accounts as new accounts. “In the first half of 2023 we have seen less M&A activity that would result in that new balance being higher,” the report states.

Contributions and Withdrawals

Account holders contributed $29 billion to their accounts in the first half of 2023 (up 11% from the year prior) and withdrew $21 billion from their accounts during the first half of 2023 (up 16% from year prior).

Based on the 2023 year-to-date contributions, 31% of all HSA dollars contributed to an account came from an employer. The average employer contribution was $726 (for those making contributions). On the flip side, 57% of all HSA dollars contributed to an account came from an employee. The average employee contribution was $1,327 (for those making contributions).

Meanwhile, 11% of all HSA dollars contributed to an account came from an individual account not associated with an employer. In this case, the average individual contribution was $1,957 (for those making contributions). The remaining contributions in the first half of 2023 came from IRA rollovers and other sources, the report notes.

Future Focus

HSA providers project HSA industry asset growth of 15% in 2023 (up from 13% at the end of 2022), while anticipating their own business will grow by 23% during the same period (up from 17% at the end of 2022).

Devenir notes that HSA providers, historically, have been fairly accurate with their growth forecasts. However, as a greater share of HSA assets are held in investments, market movement will “make forward-looking projections more difficult.” The firm currently projects that the HSA market will exceed 40 million accounts by the end of 2025, holding over $150 billion in assets.

The findings are based on a survey consisting largely of the top 100 providers in the HSA market and was carried out in the summer of 2023, with data requested for the period ending on June 30, 2023.

Access to Devenir’s 2023 mid-year HSA market survey report can be found here.

- Log in to post comments